For the in-house teams that operate on a calendar year, Q3 is the annual harbinger of two somewhat dreaded words: budget season. (For those of you on different fiscal years, rest assured, your time is coming.)

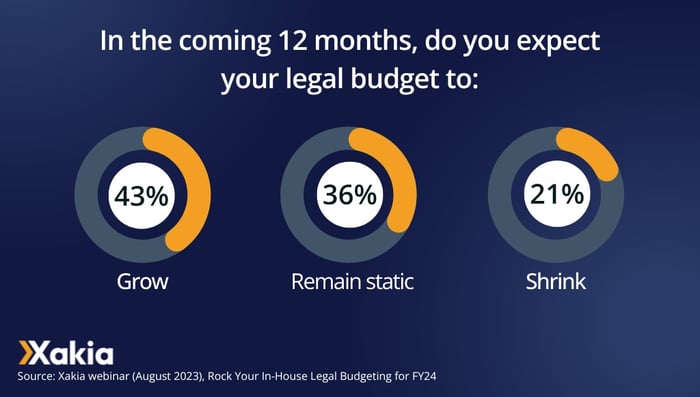

And it’s more important than ever to get the legal budget right. According to a Xakia flash poll, more than half – 57.1 percent – of in-house lawyers expect their budgets to stay flat or decrease in the next 12 months. Specifically, 21.4 percent expect their budgets to shrink.

When resources are tight, the old approach of “last year plus three percent” won’t cut it. You need a legal budget that accurately reflects strategy and business reality — and a budget that will pass scrutiny from your friends in Finance.

Xakia developed a framework, 10 Steps to a Smarter In-House Legal Budget, that can help you construct the right plan for your legal team.

But how do these steps work in the field?

We turned to Jerry Sharum, the vice president of Legal at Cribl, a data management platform. Mr. Sharum’s 15 years of experience in-house spans legal operations, state and federal litigation, compliance, human resources, intellectual property and…budgeting. In fact, he spoke to us from Cribl’s off-site planning meetings – the perfect time to provide candor and straightforward advice for other in-house lawyers this budget season.

Step One: Think strategically, and think long-term.

Guidelines:

- Before even starting your budget, talk with business unit leaders and the C-suite to learn about their initiatives and related legal needs.

- Also keep in mind your Legal Department’s strategy; you will want to ensure your budget captures the cost or savings from legal operations initiatives.

- Look ahead; draft your budget over a three-year window to show the effects of financial decisions beyond the short-term.

Put Into Practice:

Again, Mr. Sharum spoke to us from an internal planning session, where every department head prepared a budget and collaborated on a three-year modeling plan.

“Going into this week, every one of our department heads has prepared a budget, we have gone through a three-year modeling plan, and we have a relatively clear idea of what we are going to do next year,” he said. “To get there, [Legal has] to be involved in meetings with every single one of the department heads so I know what they were going to be thinking about asking for next year, two years from now, and three years from now. If your company is a high-growth company like mine, maybe you have fundraisers coming up or maybe you have an IPO target five or six years in the future.”

Mr. Sharum emphasized the importance of connecting business initiatives to Legal’s workload, and offered the example of talking to the Sales function: “One of the first questions I want to know is how many reps are you hiring next year? That will have a material impact on how many tickets I get for contract reviews or other things.

“You just have to get a feel for what you are looking for from your other business units so you know how to talk about your own budget.”

Step Two: Account for your people costs.

Guidelines:

- As one of your largest budget categories, this is important to get right.

- Think holistically about your team, from potential new hires to retirements.

- Also consider your resourcing: Could you shift any of your outside counsel spend to new in-house resources?

Put Into Practice:

Mr. Sharum recommends starting with benchmarking data from the Association of Corporate Counsel or the Corporate Legal Operations Consortium: “They have great benchmarking data to get a feel for how many folks you need in your department at this scale. What functions are in your department at this scale?”

Later, Mr. Sharum said it’s helpful to catalog your internal capacity metrics – for example, how long it takes to turn around a sales contract. This helps not only predict your internal spend, but can help you protect resources when the C-suite may be looking for cuts: “In order to do the number of deals we have to do this quarter or this year, I need to have X number of people doing them because it takes, on average, a single person to do 15 contract reviews a week.

“That is a great metric to have because you can show your ability to meet those needs, and you cannot go below that, otherwise other goals will be at risk.”

Step Three: Plan your outside spend.

Guidelines:

- This is typically the second-largest category, so it’s another key focus area.

- Start with assessing the “business as usual” work: What are your projections for the recurring, necessary legal matters that keep the proverbial lights on?

- Next, move to the special projects. (This is where your strategy work pays off from Step One.) What special project work do you anticipate – mergers, expansions, divestitures?

- Consider your current litigation and estimate potential disbursements.

- As you do this work, get ahead of any surprises by communicating with your law firms about rate increases, efficiency and value.

Put Into Practice:

Mr. Sharum operates on a fiscal year of February 1, so his budget is finalized in November – ahead of most law firm budgets (and the associated rate increases).

“For these big law firms, they are not really going to care that you are on that fiscal year,” he said. “Their fiscal year is different.”

He addresses this first by having – and enforcing – billing guidelines that state all rate changes must be received in November. When extraordinary rate increases occur, he recommends first refusing the rate increase; if you need to make it work, negotiate a blended discount for the six to eight months it takes to get out of the fiscal year to “lessen the blow.”

“Once they appreciate where you are coming from, they will not dismiss your objection quite so easily, and they are willing to work with you, in my experience,” he said, “to make it palatable so you can actually afford to do the things you need to do.”

Step Four: Plan for contingency collections.

Guidelines:

- Document any anticipated contingency revenue on your budget.

- Address litigation value, contingency, likelihood of payment and estimated timing.

Put Into Practice:

Mr. Sharum noted this is particularly important for public companies: “These sorts of things inform disclosure requirements, and they absolutely inform how accounting will treat a charge related to collections…It is really important that they match exactly so you do not have any disclosure issues and you understand how the Finance team is going to be accounting for that charge.”

Even if you are not public, Mr. Sharum said contingency collections could surface in an audit; you will want to show both Legal and Finance observed standard practices for reporting.

“One of my common refrains is ‘be really close with your Finance team,’ and this one is a really important one because it can have real funky consequences if you are public and/or you are getting audited,” he said.

Step Five: Fund your technology tools.

Guidelines:

- Take an inventory of the legal technology tools you currently have; what expenses will they bring in the year ahead? Remember to factor in subscription or user costs for new hires, as well as maintenance, licensing fees and upgrade costs.

- Next, consider your in house legal department software technology wish list. What new tools should you plan for this year and in the two years ahead?

Put Into Practice:

Don’t just document the expenses from in house legal software technology, Mr. Sharum advised – show the savings, too.

This is where it can be helpful to refer back to internal capacity metrics, he said: “If you are looking at one of the premier contract management tools, it is really important to know what this is going to save you on outside counsel spend or how much time you are going to free up on your paralegal’s or commercial attorney’s time to use this particular tool.

“It really is about quantifying, at this stage, the bang for the buck.”

Step Six: Account for your knowledge resources.

Guidelines:

- Budget for the tools you rely on for legal research, industry research and continuing legal education.

- Take a moment to consider any skill gaps or succession planning considerations: Are there any areas where your team needs additional training?

Put Into Practice:

Mr. Sharum advises having the knowledge conversations early, as many people forget about continuing legal education until they are on deadline, and from a long-term perspective.

“Really, this is a part of your career planning for your employees,” he said. “It is a succession plan to make sure your folks have the training and the skills that you need for sure right now, but also in six months or in a year.”

For example, he said, if an IPO was on the horizon, invest in training for securities and compliance.

Step Seven: Document your operating costs.

Guideline:

- Don’t forget the little things that go into running the Legal Department: team travel, team-building activities, holiday celebrations.

Put Into Practice:

Mr. Sharum noted that Legal Departments should think about what relationships merit in-person investment – an especially meaningful tactic for remote-first environments. Without a specific budget, this “face time” is unlikely to happen.

“We have to get together in person to plan, to workshop, and do all of those things,” he said, “but I need to plan for that.”

Do not overlook opportunities for the legal team to connect with other business units, he said.

“I need to plan to have some folks go to the in-person quarterly business reviews that my sales team is doing, because those relationships pay dividends on dividends on dividends if you make investments in those relationships,” he said. “Treat it as an investment in those relationships and getting really close to the business that you are serving. I think you will have a lot of joy in making sure that is covered in your budget.”

Step Eight: Adjust for division contributions.

Guidelines:

- Every organization is different; your protocols for assigning costs to business clients will vary.

- Enter your business-as-usual projections as well as those special projects that surfaced during Step One’s strategy talks.

Put Into Practice:

Even if you do not do cost allocation, Mr. Sharum advised that you not skip this step, as it may help you identify advocates for Legal Department funding.

“It is super important to know how your work is being consumed by your various business units so you can have those conversations, not just in the budget process, but when you are heading into your budget process to say ‘Hey, Sales Leader, you are occupying 70 percent of my work. I need some help. I need some support from you to get what I need in this budget,’” he said.

Moreover, this process helps with trendspotting and troubleshooting, he said. If Marketing is consuming more legal services, it’s worth a conversation: “Is this going to be a trend that continues, or is it really going to ramp up? Do I need to plan for more?”

Step Nine: Anticipate expenses that might roll over into the new year.

Guidelines:

- Accrue for any legal bills that might creep into the year ahead.

- Encourage your law firms to submit year-end bills as soon as possible.

Put Into Practice:

This is another area where clear billing guidelines are helpful, Mr. Sharum said.

He recommended that Legal Departments not use boilerplate “I am going to send them out and hope for the best” guidelines, but draft and share a real set of guardrails.

“Make it part of the relationship,” he said. “Make sure, for example, when you sign a new engagement letter that it is consistent with the billing guidelines…and have the confidence to address late bills that come in, say, six months after the project ended. I have a poor view of those kinds of bills, so have the confidence to have a strong response for those.”

Step Ten: Resolve to monitor spending in the year ahead.

Guidelines:

- Monitor your legal budget consistently so you can course-correct quickly.

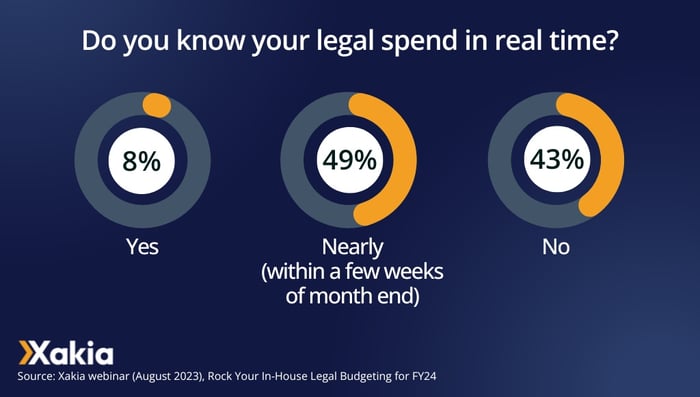

- According to a Xakia flash poll, just 8.1 percent of Legal Departments have real-time access to their legal spend; if you are among the majority that do not, resolve to address this in the year ahead.

Put Into Practice:

Mr. Sharum looks at his budget data daily.

“If you know how much you have left in your budget, you know what you can still spend money on,” he said. “You can reprioritize and reallocate across your various projects, but if you do not know until end of quarter…that is going to be a real problem when a new need comes up. You may spend it now and not have the funding to get that new tool in place, or do an entity change, whatever the case may be.”

Budget visibility begets flexibility, he emphasized – a key for the unpredictable environments that many Legal Departments must navigate.

“It really is about being able to have that flexibility to change your priorities midstream so that you at least know, ‘Hey, if I choose this, I cannot have this,’” he said. “It is a zero-sum game sometimes for budgets….just know what piece of the pie you are giving away so you can be intentional about it.”

Watch the webinar on demand: Rock your in-house legal budget

Watch the webinar on demand with Anne Post and Jerry Sharum, VP Legal at Cribl and learn how to create a top-notch budget.

Watch the webinar on demand with Anne Post and Jerry Sharum, VP Legal at Cribl and learn how to create a top-notch budget.

We also recommend downloading the white paper and legal department budget template so you don't have to start from scratch.

Download here: 10 Steps to a Smarter In-House Legal Budget

Keep track of your legal budget with a matter management solution

If you would like to learn how a legal matter management system can help you keep track of your legal budget, get in touch with the Xakia team today.